Fdic Coverage Per Account

This applies to both principal which is the money that you have deposited in your account and any money that youve earned as interest since depositing your money.

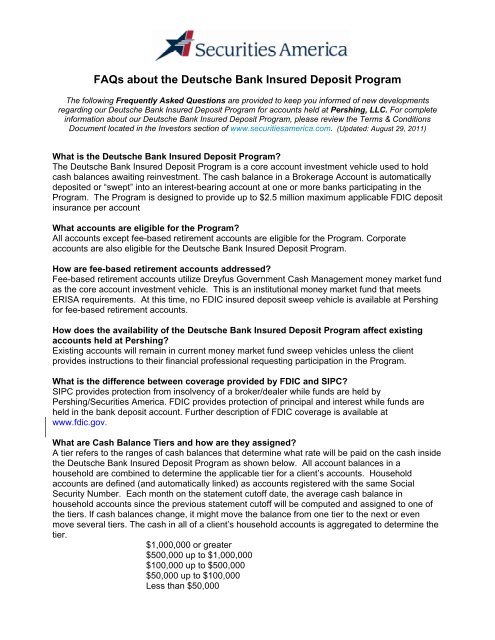

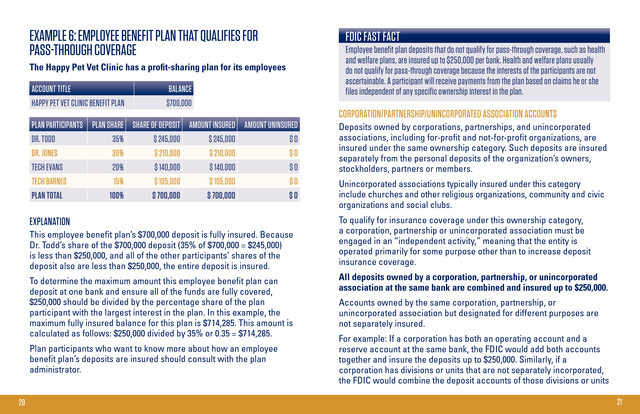

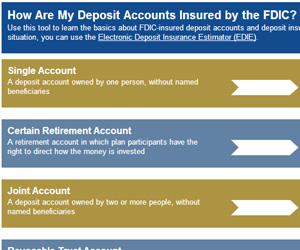

Fdic coverage per account. Depositors may qualify for coverage over 250000 if they have funds in different ownership categories and all fdic requirements are met. How are my deposit accounts insured by the fdic. These are accounts in only one persons name. Single accounta deposit account owned by one person without named beneficiariescoverage limit.

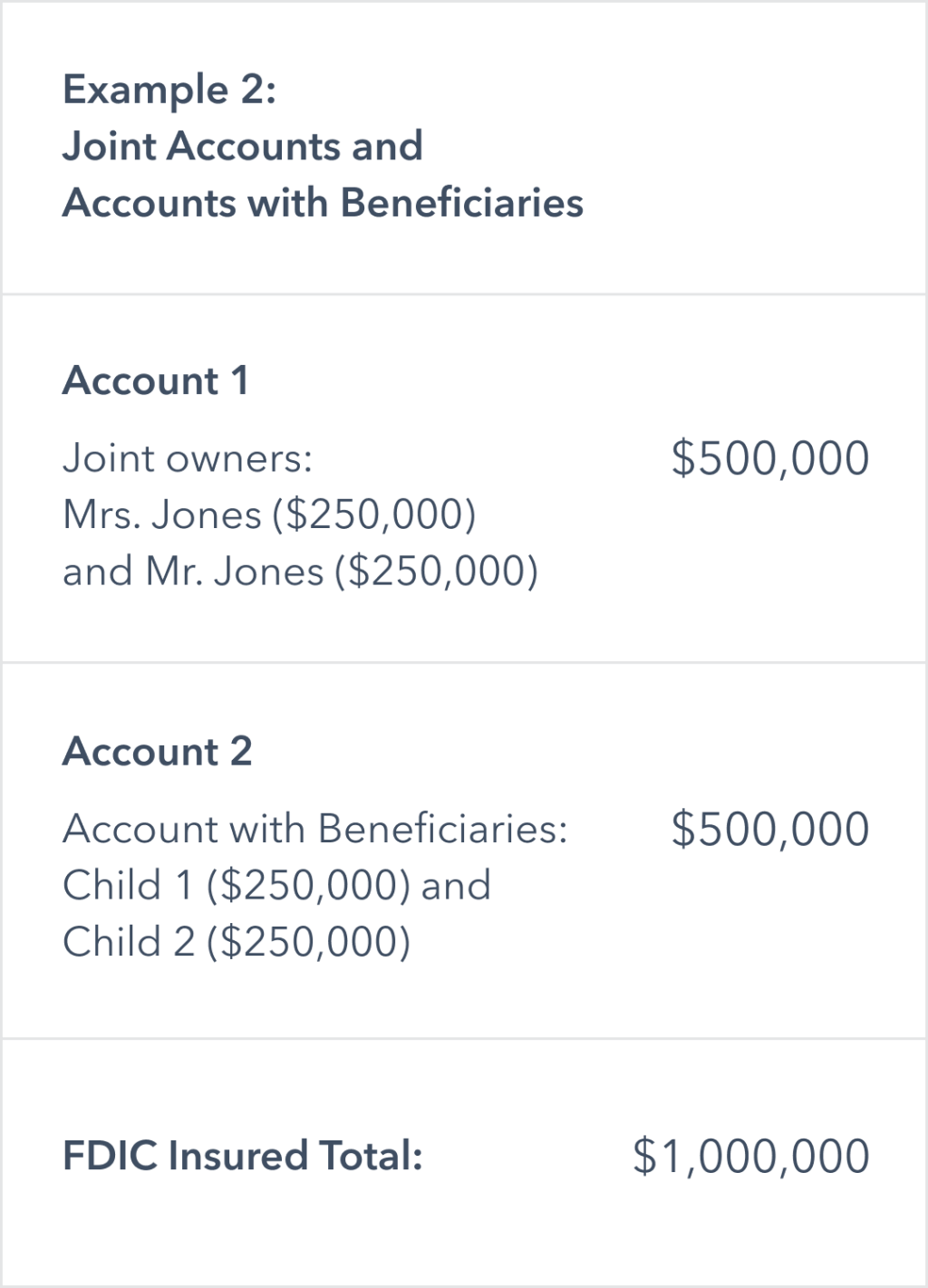

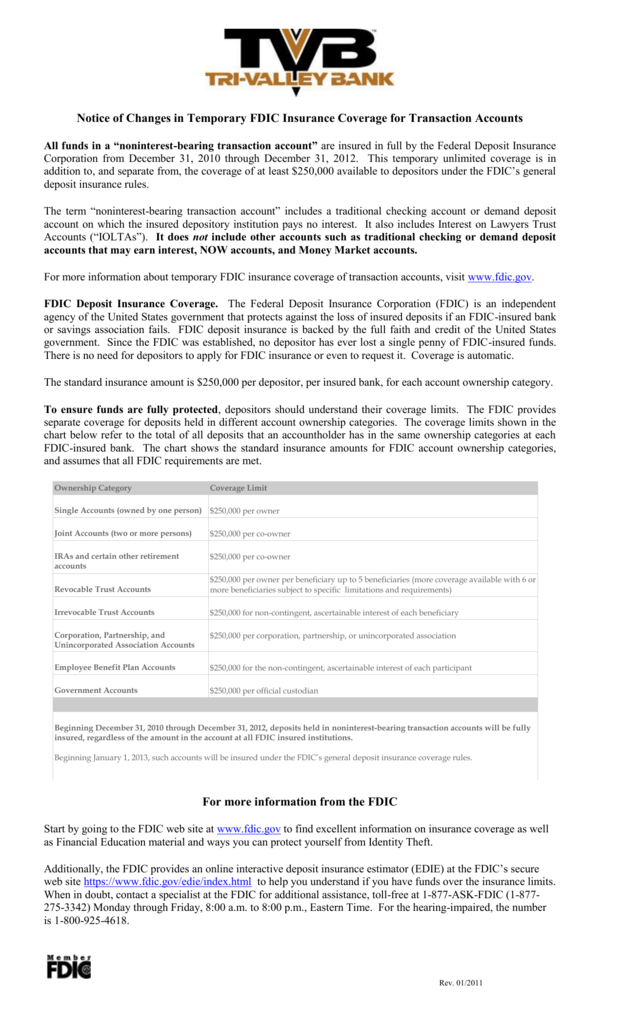

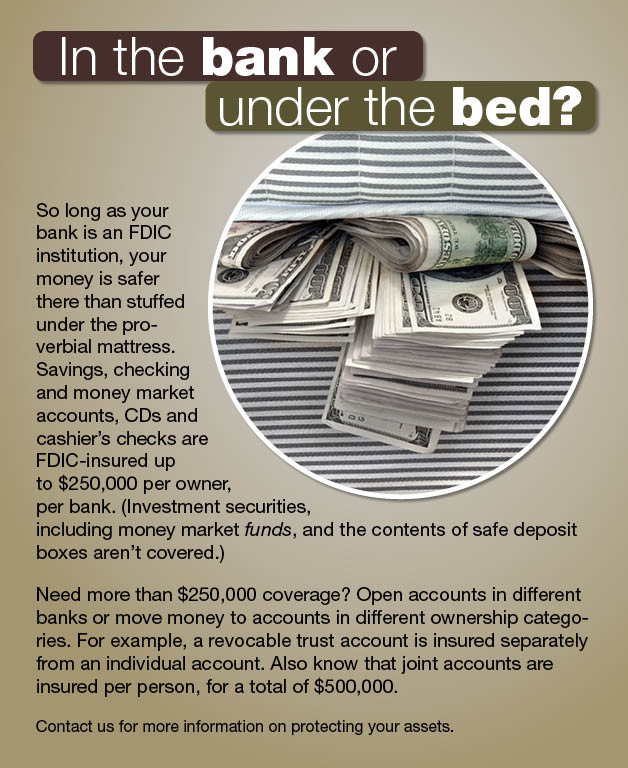

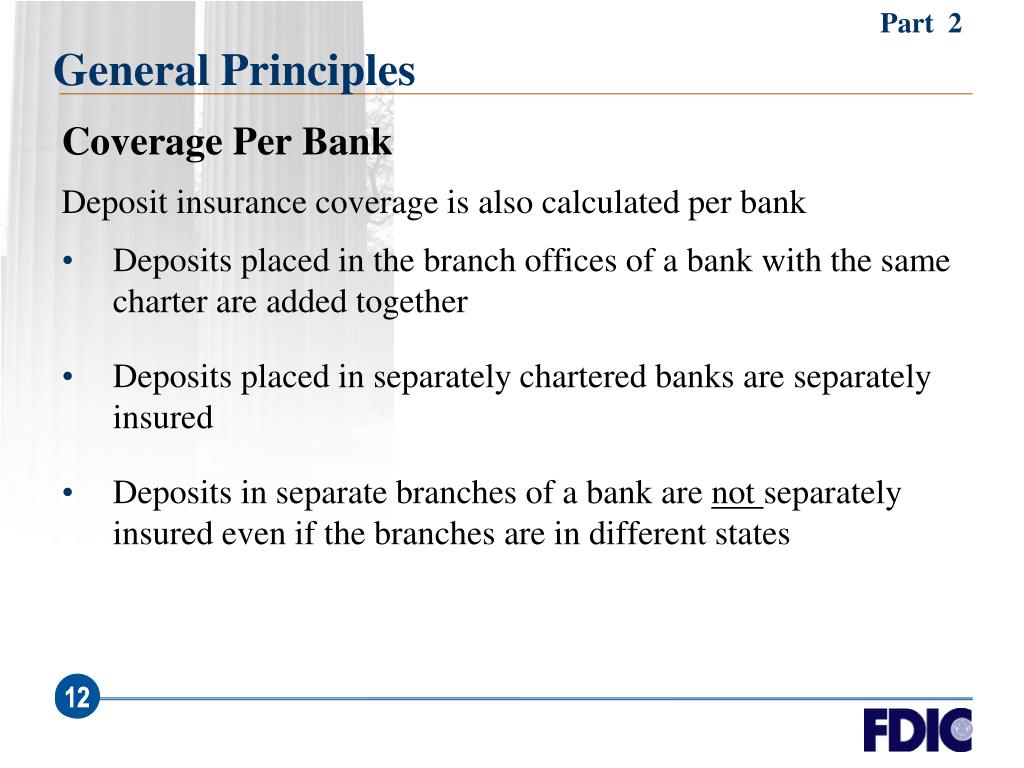

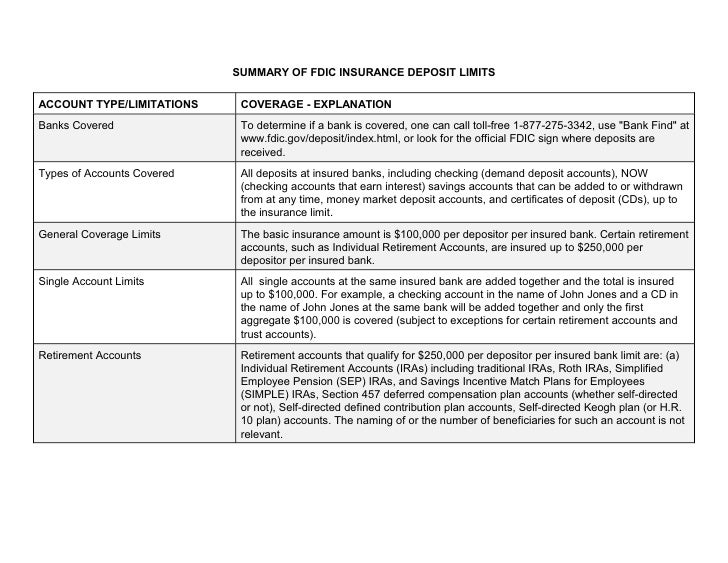

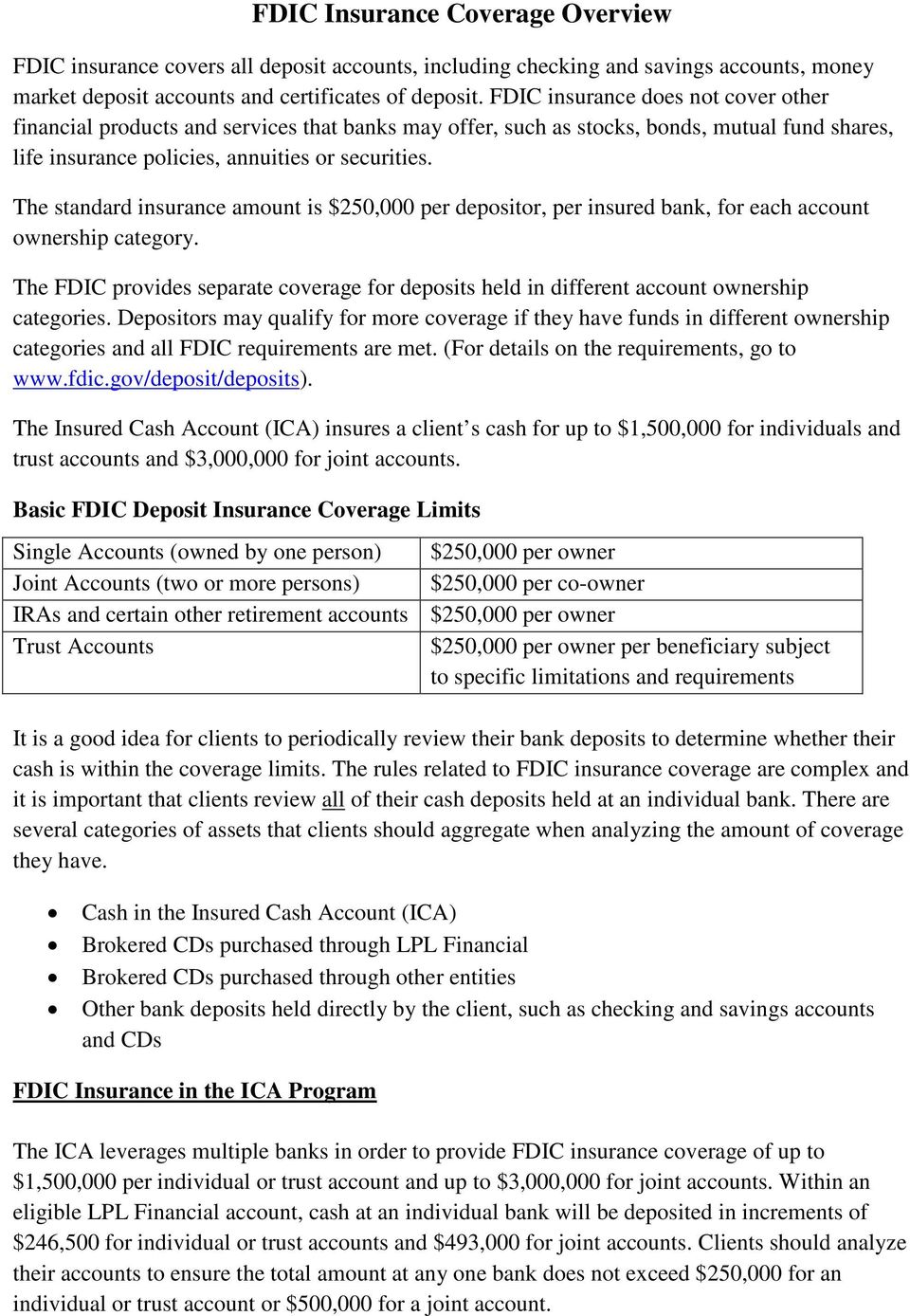

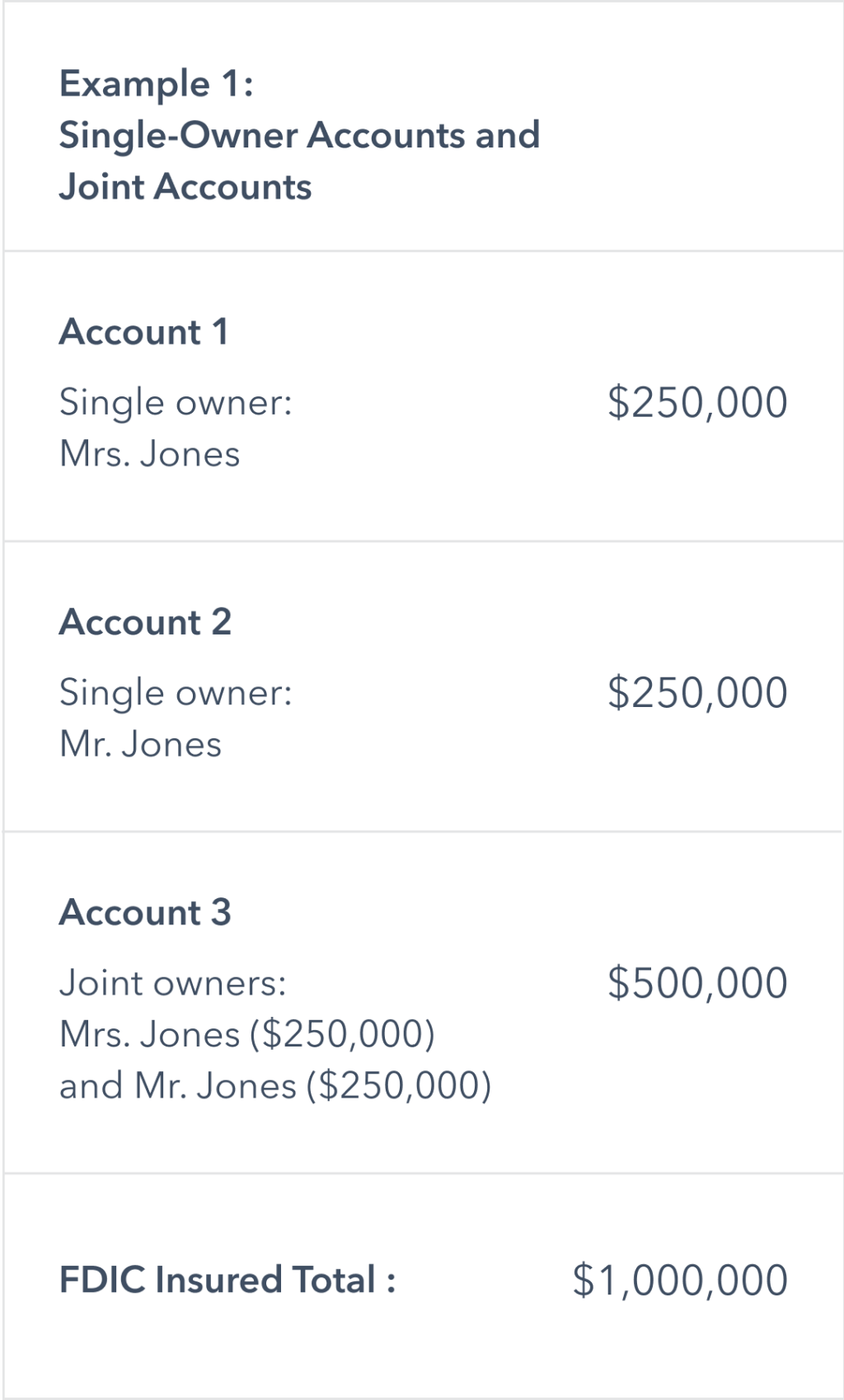

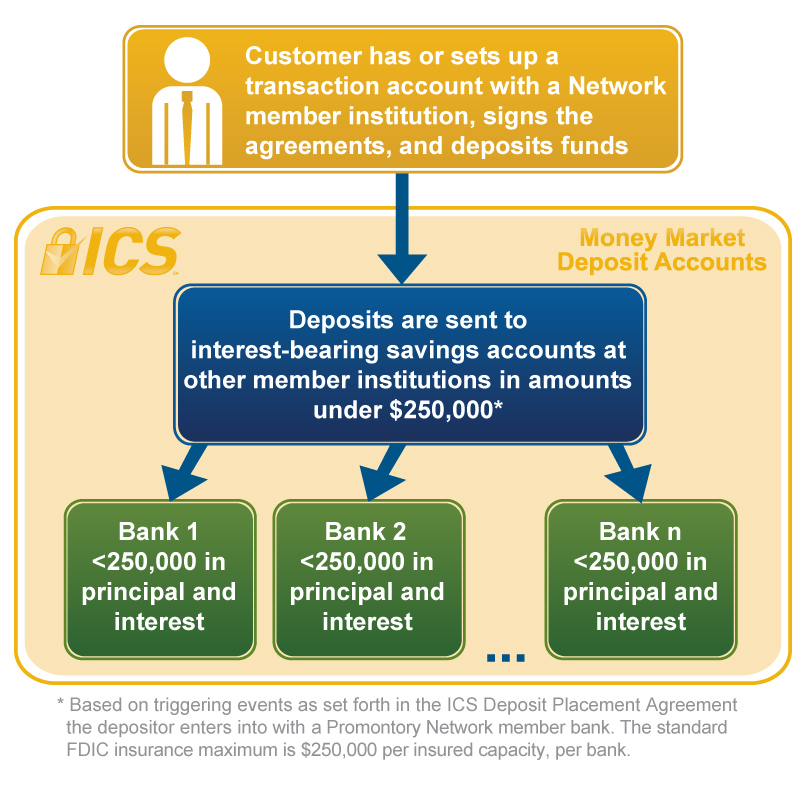

The standard insurance amount is 250000 per depositor per insured bank for each account ownership category. The fdic insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank. The standard deposit insurance coverage limit is 250000 per depositor per fdic insured bank per ownership category. The fdic provides separate coverage for deposits held in different account ownership categories.

The general rule is that the fdic covers 250000 per depositor per fdic insured bank per ownership category. Fdic insurance covers funds in deposit accounts including checking and savings accounts money market deposit accounts and certificates of deposit cds. How fdic insurance coverage is calculated single accounts. The standard deposit insurance amount is 250000 per depositor per insured bank for each account ownership category.

All accounts owned by the same one person at the same. The standard insurance amount is 250000 per depositor per insured bank for each account ownership category. Assuming all owners have equal rights to the money in. Fdic insurance does not cover other financial products and services that banks may offer such as stocks bonds mutual funds life insurance policies annuities or securities.

Certain retirement accounta retirement account in which plan participants have the right to direct how the money is.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-8611291101-5b39ea3dc9e77c0054f9fcc5.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1083369608-fd8869a31a224579abf27d7033670051.jpg)

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)